News & Tips • Employee Benefits: What Does the Average Employer Spend?

Employer vs Employee Contributions to Health Insurance

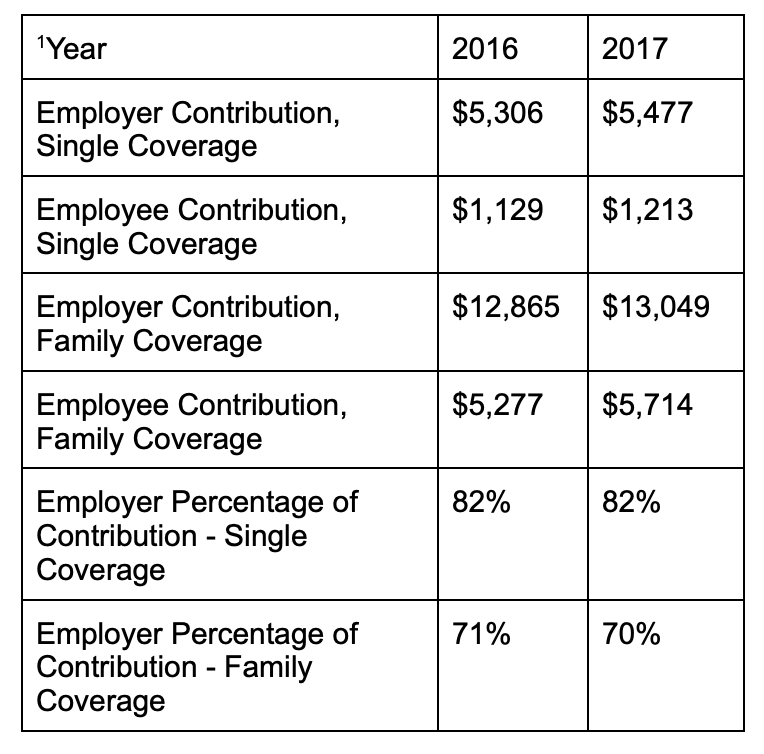

The Annual Kaiser Family Foundation (KFF) Health Benefits Survey summarizes data from employers across the country in an annual report to aid in research and development. Here is the breakdown for employer versus employee contributions to health insurance from 2016-2017:

In terms of medical compensation costs, state and local governments tended to spend more on their employee benefits than the public or private sector. The lowest rate of compensation among government workers is in hospitals at 11.1%. Comparatively, the rate of coverage in the service industry sits at 6.9%. Medical benefits are nearly ubiquitous in employee benefits package negotiations and the vast majority of companies and private firms (67% and 70% respectively) offered their employees medical insurance in 2016. Increasingly, they dominate employee/employer relationships.

According to the Kaiser Family Foundation’s 2016 Employer Health Benefits Survey, employers covered an average of 82% of premium costs for those enrolling in individual coverage. Workers in small firms are likely to pay higher rates for family coverage, with an average employee contribution of 39%.

A complete picture of the cost of employee benefits ought to include premiums, copays, voluntary benefits, workers compensation, network access, administrative costs, and performance guarantees. Providing such benefits can keep you competitive against those with whom you compete to hire the best employees.

Data Courtesy of the KFF: https://www.kff.org/health-costs/report/2016-employer-health-benefits-survey/

French, Michael T., et al. “Key Provisions of the Patient Protection and Affordable Care Act (ACA): A Systematic Review and Presentation of Early Research Findings.” Health Services Research, vol. 51, no. 5, Oct. 2016, pp. 1735–71. DOI.org (Crossref), https://doi.org/10.1111/1475-6773.12511.

Book an Appointment!

News & Tips from the Stockton Team!

Be in the know!

HRA vs. HSA: Let’s Compare!

News & Tips • HRA vs. HSA: Let’s Compare!A Health Savings Account (HSA) is a savings account linked to a qualified high deductible health plan or HDHP. It assists employees in offsetting the out of pocket expenses that come with an HDHP. Many of these accounts are...

The Impact Behavioral Economics is having on Employee Benefits in the Workplace

News & Tips • The Impact Behavioral Economics is having on Employee Benefits in the WorkplaceThe American history of medicine and organized healthcare is quite a bit different than that of most other first world countries.While the Civil war propelled the progress of...

The Top 10 Commonly Offered Employee Benefits

News & Tips • The Top 10 Commonly Offered Employee BenefitsLooking to offer your employees a competitive benefits package but don’t know where to begin? There are some important things you should know about what is required of you. Beyond that, there is a bevy of...

Consumer-Driven Healthcare, What are the Pros and Cons?

News & Tips • Consumer-Driven Healthcare, What are the Pros and Cons?Consumer driven healthcare plans are those with low premiums, high deductibles, and employee funded health savings accounts. In order to reduce costs for employers, CDHC policies seek to put the...

Let’s Talks High Deductible Health Plans (HDHP), is yours HSA Qualified?

News & Tips • Let's Talks High Deductible Health Plans (HDHP), is yours HSA Qualified?The American history of medicine and organized healthcare is quite a bit different than that of most other first world countries.While the Civil war propelled the progress of...

Health and Wellness in the Workplace, What is the Difference?

News & Tips • Health and Wellness in the Workplace, What is the Difference?Quitting smoking is a very difficult thing to do. People enjoy the satisfaction of an addiction and prefer instant gratification over long term benefits. Much like going to the gym, resisting a...